MUMBAI: In a bid to get companies to adhere to the rules relating to unpublished price sensitive information (UPSI) in letter and spirit, Sebi seeks to expand the list of corporate events that would qualify as UPSI. A consultation paper published by Sebi on Sunday indicated that presently, there exists ambiguity regarding what constitutes UPSI. Hence, it wants to enumerate all such possible events which could qualify as UPSI. The regulator also aims to maintain its ‘ease of doing business’ objective while not substantially increasing compliance obligations for listed entities.

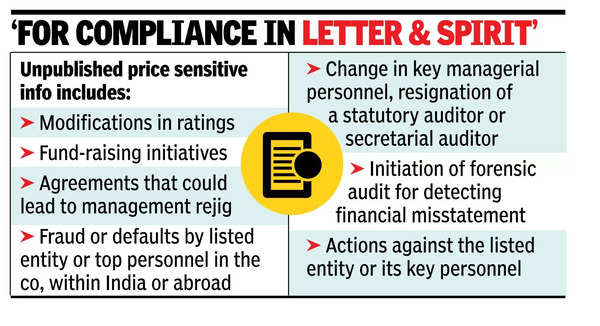

A working group was established to propose modifications to the list of events qualifying as UPSI. It proposed only modifications in ratings to be incorporated in the list of events qualifying as UPSI. Additionally, fund-raising initiatives proposed by a company should be included in it. Sebi also proposed that agreements that could lead to change in management and control of the company should qualify as a UPSI.

Any fraud or defaults by a listed entity, its promoter, director, key managerial personnel, senior management, or subsidiary or arrest of key managerial personnel, senior management, promoter or director of the listed entity, whether occurred within India or abroad, should also qualify as a UPSI. A change in key managerial personnel and resignation of a statutory auditor or secretarial auditor should be included in the list too. However, the list should exclude superannuation or completion of terms of top people at a company.

Sebi also proposed to include resolution plans, restructuring, one-time settlement regarding loans, borrowings from banks, financial institutions etc to be included in the list.

Admission of winding-up petition filed by any party, creditors, admission of application by the corporate applicant or financial creditors for initiation of corporate insolvency resolution process (CIRP) of a listed corporate debtor and its approval or rejection thereof under the Insolvency Code should also be in the list. The working group proposed that only the NCLT-admitted winding-up petitions would constitute UPSI. A mere application to NCLT may be excluded. Any event of initiation of forensic audit for detecting financial misstatement, misappropriation, siphoning or diversion of funds and receipt of final forensic audit report should also qualify as a UPSI, the paper noted.

Any actions by a regulatory, statutory, enforcement authority, along with judicial actions, orders against the listed entity or its directors, key managerial personnel, senior management, promoter or subsidiary should be included in the list. Any award or termination of orders, contracts outside normal business operations should also qualify as UPSI, the paper said. Litigation or outcomes of dispute affecting the listed entity should also be included. Sebi has requested feedback on these proposals from the public by Nov 30.